With the volume of information stored online today, it’s easier than it’s ever been for hackers and thieves to uncover your personal assets and strike gold. But where exactly are they pulling off their heists, and just how much are they running off with?

To answer this question, we looked at data sources across crypto markets and Federal Trade Commission reports to pin down just how much and where people are losing their assets.

Where People Are Losing the Most

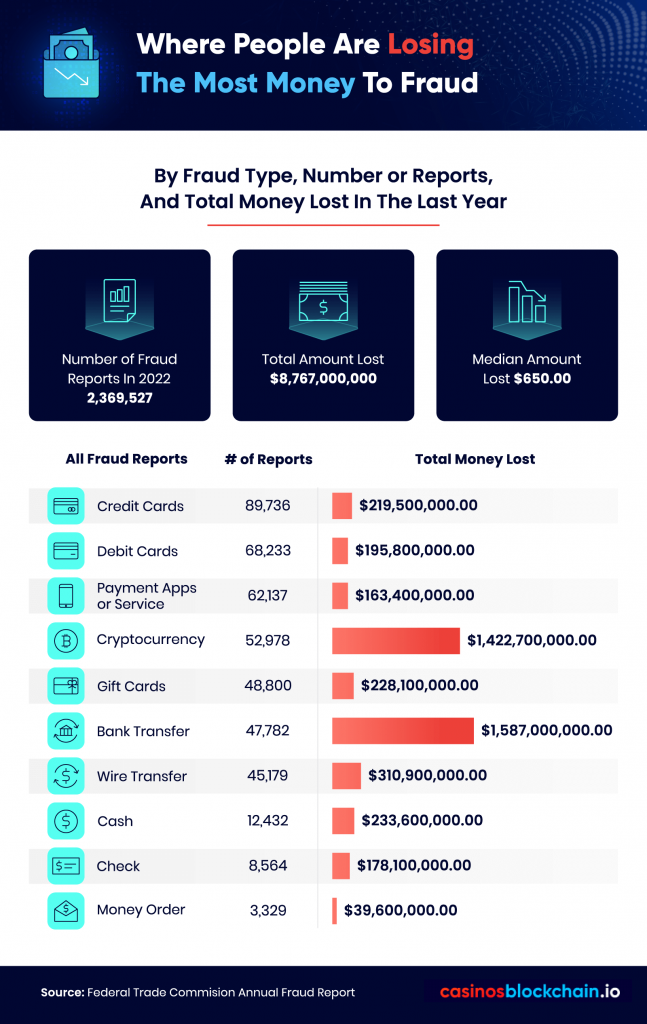

According to data sources across crypto-markets and FTC reports, credit card theft is still the most common, but the most lucrative swindling takes place with bank transfers.

Out of the 2,369,527 money fraud reports in 2022, the most frequent reports were for credit card fraud. A total of 89,736 credit card thefts were reported, totaling a loss of $219,500,000.00. Although staggering, these numbers are far from the total amount of money lost with bank transfers and cryptocurrency frauds.

That same year, crypto fraud was reported 52,978 times totaling an eye-watering $1,422,700,00.00 lost! And just when you thought this was the peak of money fraud in 2022, Bank Transfer fraud, which occurred less frequently than the two fraud types previously mentioned, was hit even harder! The 47,782 reported bank transfer thefts in 2022 totaled losses of $1,587,000,000.00.

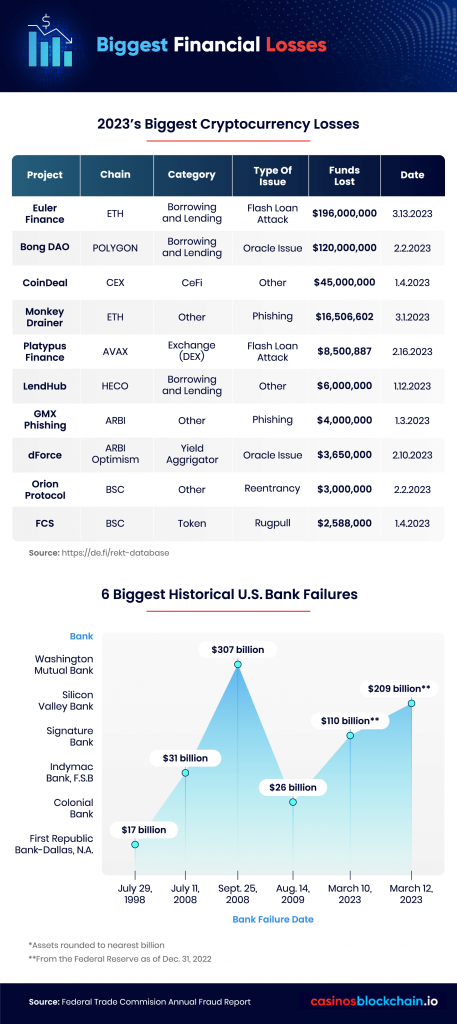

The Top Hacks

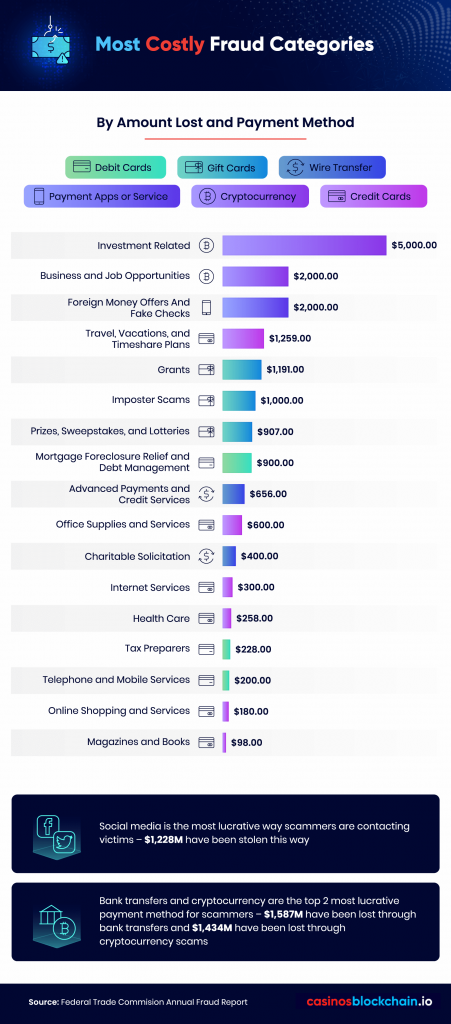

Crypto is not being stolen in high numbers based solely on how secure your hot wallet is. In fact, these crypto-frauds are most commonly taking place in what many victims believe to be ‘business and investment opportunities’.

According to the Annual Fraud Report by the FTC, the average amount of money lost to an Investment-related crime was $5,000.00, with an average loss of $2,000 for crimes committed in relation to business and job opportunities.

Since 2021, a crypto-craze has emerged among mainstream culture and catapulted in popularity thanks to its representation among celebrities and televised ad placements, some of which were even aired during the Superbowl. This resulted in numerous people with little understanding or experience of crypto rushing to find investment opportunities for their newly acquired coins.

Fearful of missing out on what many believed to be the digital gold rush, people began falling prey to services that promised quick and easy returns on their investments. The reality of this seemingly great investment opportunity? Your investment was sent directly into the scammer’s wallet.

So where are victims of crypto fraud being baited? On social media platforms, of course!

- Discord

These are all platforms being used by thieves to conduct their crimes.

Crypto Fraud & the Banking Collapse of 2023

Recent weeks saw the failures of both Silicon Valley Bank and Silvergate Bank, both of which were used heavily by crypto-based companies. As cryptocurrencies are not generally protected by the Federal Deposit Insurance Corporation, investors were faced with the potential reality of all of their assets vanishing with the fallen banks.

But, investors who entrusted their assets to Silicon Valley and Signature let out a sigh of relief as the FDIC promised that deposits made at both banks would be protected.

Since the FDIC announced its intentions to insure crypto investors at these banks, cryptocurrency prices for Bitcoin and Ether have jumped up 20% in the last few days alone.

The Federal Deposit Insurance Corporation will arrange the sale of a failed bank’s assets to a thriving bank or, less commonly, will pay the bank deposits back directly. The big question looming is whether more crypto-focused bank failures will arise.

In a fast-acting response to the fallout across the banking sector, the Federal Reserve created the Bank Term Funding Program (BTFP), a lending program that will provide emergency loans to banks facing a similar fall for up to one year.

How We Painted The Picture

To find out where investors and consumers are losing the most to fraud, we analyzed data from the Federal Trade Commission’s latest annual Fraud Report, which encompassed fraud reports from January 1st, 2022 through December 31st, 2022.

Information on cryptocurrency losses was sourced from the REKT database, courtesy of De.Fi, which based its information on the following 13 blockchains: Binance Smart Chain, Ethereum, Polygon, Fantom, Avax, EOS, Solana, Heco, KuCoin, TRON, Near, Polkadot, and Algorand.

Finally, we used The Federal Reserve Statistical Release on Largest Commercial Banks to determine the historical banking losses, which compiled banking losses up until the date of publishing.

Share The Facts

Interested in sharing our data Feel free to use the images and data we shared here for noncommercial purposes. Just don’t forget to link back to this page to give the authors proper credit.